1:03 Not registered for Paychex Flex Learn how to here. Under Tax Documents, click the PDF icon to download your W-2 or 1099. To reinstate a closed account, contact the IRS for direction. Employees Administrators Employees Looking for W-2s in Paychex Flex Log in to Paychex Flex. If you have a copy of the EIN Assignment Notice that was issued when your EIN was assigned, include that when you write. To close your business account, send the IRS a letter that includes the complete legal name of the entity, the EIN, the business address and the reason you wish to close your account. The EIN will still belong to the business entity and can be used at a later date, should the need arise. W-2s come from your employer, and they have until January 31 to issue it. After you enter the first one, you click Add Another W-2. Go to Federal>Wages & Income to enter a W-2. ALL of your W-2’s must be entered on the SAME tax return.

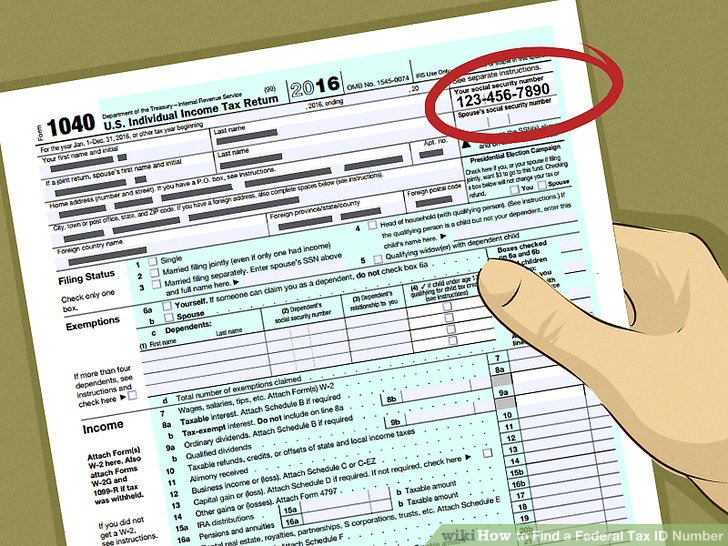

If the business entity type or ownership changes, a new EIN will be needed.Ĭlosing an EIN Account: An EIN cannot be cancelled, but it can be closed. You do not want to get in trouble with the IRS for under-reporting your income. The process is quick and cost-free.Ĭhanges: Businesses having an EIN must notify the IRS when changes in address, location or responsible party occur by filing form 8822-B. SBA.govs Business Licenses and Permits Search Tool allows you to get a listing of federal, state and local permits, licenses, and registrations youll need to run a business. A number can be obtained by mail, phone, or fax. TurboTax will help you import your W-2 directly from your employer using their Employer Identification Number (EIN). Most banks require an EIN to open a business account. Employer Identification Numbers (EIN): Needed by businesses with employees and those making retail sales or doing business with corporations and government agencies.

0 kommentar(er)

0 kommentar(er)